You might believe that if you die while married, everything you own automatically goes to your spouse and children. However, this only happens if you die without a will, which is known as dying intestate. In Nevada, intestacy laws dictate how your assets are distributed. Generally, your spouse receives a substantial portion, but the rest depends on whether you have children or other relatives…

Complex Family Dynamics

Nevada’s intestacy laws cater to traditional family structures. In blended families, stepchildren or non-biological children may not inherit unless they are legally adopted. For instance, if Carey, who has a daughter from a previous relationship and a child with Blake, dies intestate, her assets will be divided between Blake and their child, Penny. Blake’s child, Whitley, won’t inherit, despite being treated as family.

The Probate Process

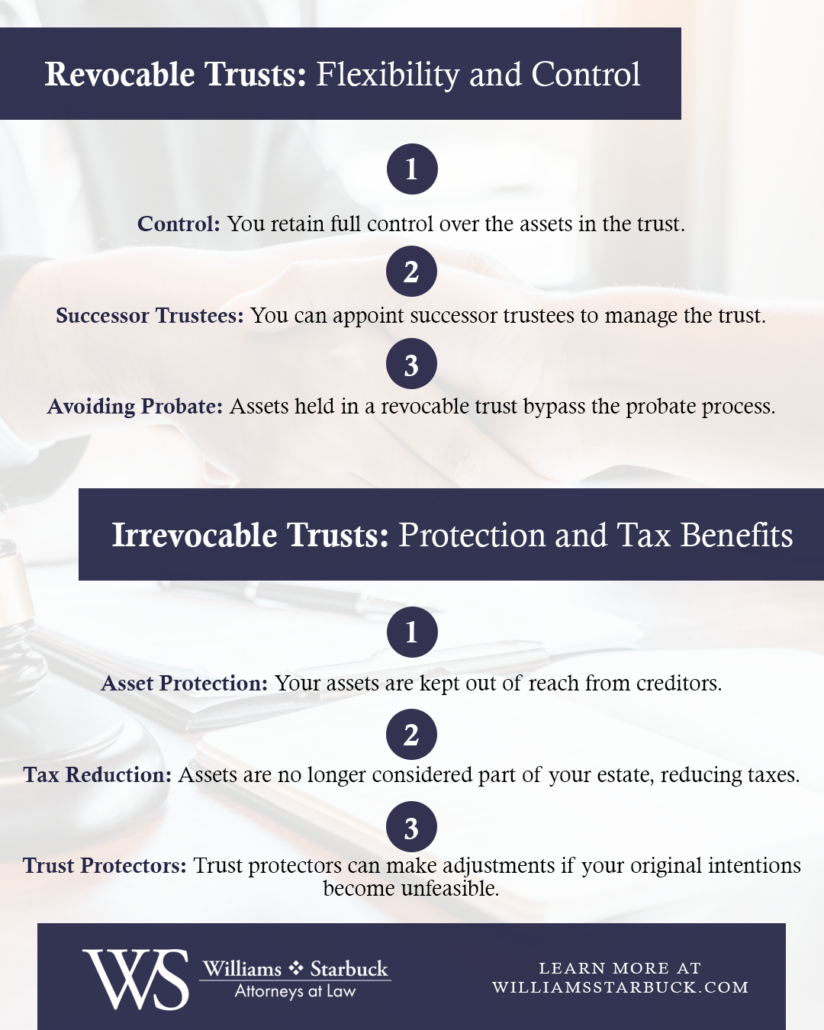

Nevada’s probate process can be lengthy, costly, and public. To avoid these pitfalls and ensure a smoother transfer of assets, set up a revocable living trust. This option allows for private and efficient asset distribution.

Guardianship for Minor Children

Without a will, Nevada courts appoint a guardian for minor children. This decision may not reflect your wishes, as it follows a statutory priority list. A will allows you to designate your preferred guardian, ensuring your children are cared for by someone you trust.

What If You’re Separated?

In Nevada, if you are separated but not legally divorced, your estranged spouse might still be entitled to a share of your estate under intestacy laws. Even if you intend to exclude them from your will or trust, state laws could grant them a portion of your estate unless you have a prenuptial or postnuptial agreement.